The NASUWT is committed to ensuring that all supply teachers have the information they need and has produced this advice and guidance to assist them when looking to assert their rights in respect to holiday pay

Supply teachers have a vital role to play in raising and maintaining high educational standards in schools.

Campaigning to secure professional entitlements for supply teachers is a key priority of the NASUWT, together with securing decent pay and working conditions for all supply teachers.

Background and context

All workers in the UK are entitled to a total of 5.6 weeks of paid annual leave each year under the Working Time Regulations (WTR), which accrues from the first day of employment. This includes supply teachers employed by local authorities, schools and employment agencies and/or umbrella companies, although it does not include those supply teachers who are self-employed.

The WTR confirm that a worker is entitled to 28 days’ annual leave (5.6 weeks) in each leave year: four weeks derives from the EU Working Time Directive (Regulation 13) and 1.6 weeks derives from UK legislation (Regulation 13A).

Your leave year should be clearly defined in your contract of employment (e.g. the calendar year).

Where a teacher works on a full-time basis (i.e. a five-day week), they must receive a minimum of 28 days’ paid annual leave per year, calculated on the basis of multiplying the teacher’s normal working week (i.e. five days) by the annual statutory leave entitlement of 5.6 weeks.

Whilst you must not be prevented from taking any holiday entitlement before it expires, employers do have discretion over when to allow you to take holiday and may, in some circumstances, require you to take all or part of your leave on particular days by giving you notice. For example, patterns of holidays for school teachers are predetermined by periods of school closure.

It is important to note that in circumstances where annual leave is not taken before the annual leave year expires, you may lose your entitlement under the ‘use it or lose it’ principle, although it is possible in some situations that you may be permitted to carry forward up to 1.6 weeks of holiday leave into the next leave year.

Holiday pay under the WTR is meant to equate to a worker’s usual rate of pay during periods of actual work, as prescribed in both the WTR and sections 221-224 of the Employment Rights Act 1996.

The amount of pay that a worker is entitled to when taking leave is based on the number of hours worked and how they are paid for the hours worked, but, in essence, under European Union law, holiday pay should reflect the pay that would have been earned if a worker had been at work and working.

For the overwhelming majority of the workforce in the UK, who are on permanent contracts with fixed hours and fixed pay, if they take a week’s holiday, they will be entitled to receive the same pay at the end of the month as if they had been at work.

This applies to teachers who are employed on a permanent basis in the UK, as they are employed and receive a salary over 12 months of the year, despite only working 195 days in an academic year.

The situation for supply teachers

For those who work in more casual arrangements, or have variable hours from week to week, such as supply teachers, knowing how much you are entitled to be paid for annual leave can be more complicated, particularly given that this will be dependent on how you are employed (e.g. through local authority pooled supply, directly through a school, or through an employment agency and/or umbrella company).

Supply teachers working through an employment agency and/or umbrella company

If you are a supply teacher working irregular hours, your entitlement to paid annual leave is likely to be calculated on a pro rata basis that is determined by your working pattern during the part of the year you are required to work.

For example, if you are a supply teacher contracted to work four days during the 39 weeks of term time, the calculation would be 5.6 x 4, which equates to 22.4 days.

Previously, in order to provide pay for periods of statutory annual leave, those with irregular hours had their holiday pay calculated pro-rated at a rate of 12.07% per hour (the ‘percentage’ method).

This method of accruing holiday pay for those with irregular hours derived from the fact that the standard working year is 46.4 weeks (52 weeks less than the statutory 5.6 weeks’ annual leave entitlement) and 5.6 weeks divided by 46.4 weeks works out to be 12.07%.

This was a calculation method previously recommended in Acas guidance and saw those with irregular hours have a pro rata amount of 5.6 holiday entitlement proportionate to the weeks worked.

Harpur vs Brazel

However, in Harpur Trust vs Brazel, the Supreme Court ruled that this method of calculating holiday pay for a peripatetic music teacher working irregular hours during term time at a school was incorrect. [1]

The Supreme Court held that every worker is entitled to 5.6 weeks’ annual leave under the WTR, without any element of pro-rating for those that do not work all round or full time. Holiday pay should therefore be based on 5.6 weeks of annual leave, regardless of the number of hours, days or weeks actually worked (the ‘calendar week’ method).

As a result of the judgment in Harpur Trust vs Brazel, all workers in the UK now receive the same minimum level of paid annual holiday leave, including part-year and irregular hours workers.

Although the Harpur Trust vs Brazel case concerned a term-time-only worker, the principles in it also mean that in some cases a 12.07% approach will not be enough to satisfy the holiday entitlements for casual workers with irregular working patterns, especially if they have a number of weeks during the year in which they do not work or are not on leave, such as supply teachers who are only able to work for 39 weeks of the year.

As such, the NASUWT contends that this ruling should apply to supply teachers employed through an employment agency and/or umbrella company who are only able to work as a supply teacher for the 39 weeks that schools are open in England and Wales.

Indeed, this is confirmed in advice and guidance (pdf) issued by the Department for Business and Trade (formerly known as the Department for Business, Energy & Industrial Strategy – BEIS).

However, it should be noted that, while term-time workers, such as supply teachers, are entitled to 5.6 weeks’ annual leave, this will not in practice necessarily equate to 28 days’ holiday.

Your actual entitlement would be determined by your regular working pattern during the part of the year you are required to work. For example, if the worker is contracted to work four days during 39 weeks of term time, the calculation is 5.6 x 4 = 22.4 days.

Establishing your holiday pay entitlement

For supply teachers working through an employment agency and/or umbrella company, with no fixed hours or fixed income each week, the holiday reference period is calculated by looking back at the previous 52 paid weeks.

If you have not been working long enough to have 52 weeks’ worth of pay to use as your reference period, your employer should use the number of complete weeks of data they have available.

For example, if you have only been working for a new agency and/or umbrella company for 20 weeks with variable pay, your agency and/or umbrella company should use the data available for the 20-week period and calculate an average using your earnings in the past 20 weeks.

It is important to note that the holiday reference period excludes any weeks in which you did not undertake any paid work, irrespective of the amount you received. The aforementioned advice and guidance from the Department for Business and Trade makes it clear that this does not include any periods of school closure where a supply teacher was not paid.

In addition, there is a limit of up to 104 weeks which can be used by your agency and/or umbrella company as the ‘look back’ period if they do not have 52 weeks of pay data for you.

For example, if you only received pay in 36 weeks of the school term, your agency should look back at the number of weeks you were paid to work in the previous year in order to establish a 52-week ‘look back’ period (remembering that this could include weeks where you have only undertaken one day’s work).

The reference period for establishing holiday pay entitlement starts from the last complete working week you worked ending on the first day of leave.

Once your agency and/or umbrella company has the relevant pay data, this is divided by the number of relevant weeks (e.g. 52 weeks) in order to provide you with the average weekly pay which you can expect to receive when you take a week’s period of holiday entitlement.

Receiving your holiday pay

You should receive your holiday pay in line with your usual pay reference period as agreed in your contract. For example, if your usual pay period is weekly, then any holiday pay should be received weekly.

Accrued vs rolled-up holiday pay

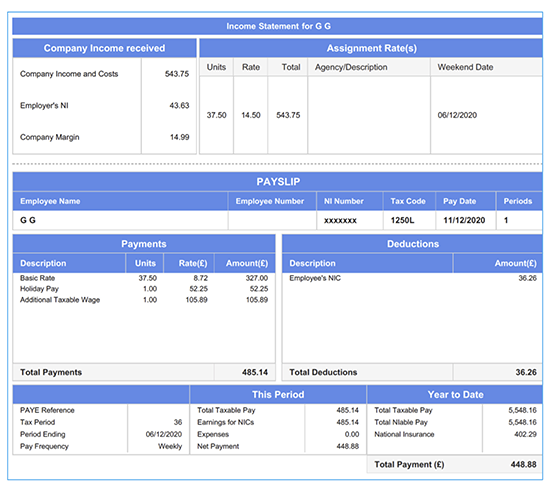

Accrued holiday pay involves the employment agency and/or umbrella company setting aside the relevant amount as your holiday pay that you access at the point when you want to take annual leave. Whilst this should be identified as a statutory deduction on your payslip (see above), it may be the case that this is just paid to you as ‘normal salary/pay’ when you take any period of annual leave.

As referenced earlier, if you do not take any annual leave before the annual leave year expires, you may lose your entitlement (under the ‘use it or lose it’ principle), although you may still be paid for any untaken holiday (‘payment in lieu’), especially in situations where you have left employment with an employment agency and/or umbrella company and not taken any annual leave.

Rolled-up holiday pay involves the employment agency and/or umbrella company paying an additional amount as part of your wages which you are then expected to retain and use when you want to take any annual leave. As stated before, this should be identified as a statutory deduction on your payslip (see figure 1 below).

Figure 1 – an example of a payslip showing rolled-up holiday pay

Employment agencies and/or umbrella companies should not seek to cut or reduce the daily or hourly rate you receive in order to compensate for paying holiday pay. You should therefore check your overarching contract of employment or key information document (KID) (see below for further information) carefully, to establish if your agreed rate of pay is inclusive of holiday pay.

If this is not the case, you should discuss this with your agency and/or umbrella company with a view to getting your rate of pay increased.

Following this, you should contact the Union for further advice and guidance.

Key information document

As of 6 April 2020, recruitment agencies who provide temporary agency workers, such as supply teachers, are legally obliged to provide a KID. This is intended to help agency workers make informed decisions by improving the transparency of information provided to agency workers regarding pay, benefits, costs, deductions and fees.

Whilst the Conduct of Employment Agencies and Employment Businesses Regulations already contain a legal requirement to provide key information about assignments to agency workers, such as supply teachers (i.e. rates of pay), the introduction of the KID goes further by expecting employment agencies to provide significant additional information to agency workers, including in regards to any annual leave entitlement and holiday pay.

In addition, the KID should include a sample statement of what happens to the money they have agreed to pay you. This must be a reasonably realistic estimate, including:

-

gross amount of pay;

-

statutory deductions (e.g. tax, National Insurance Contributions (NICs), apprenticeship levy);

-

non-statutory deductions (e.g. umbrella company administration fee);

-

any fees charged for goods or services (e.g. training, Disclosure and Barring Service (DBS)); and

-

net amount payable to you as a supply teacher (following all estimated deductions, costs and fees).

This is designed to give you an illustration of the pay that you can expect to receive.

The KID must be provided to you before an agreement is reached on terms and conditions and before a contract is issued from the employment agency and/or umbrella company.

As such, all supply teachers working through an employment business and/or umbrella company are reminded to check their contract extremely carefully, as it may be the case that you are expected to provide notice in order to take your annual leave.

Under Regulation 29 of the aforementioned Conduct Regulations, an employment agency is required to retain records for up to 12 months. In addition, financial records are supposed to be retained for six years.

Agency Workers Regulations (AWR)

The Agency Worker Regulations provide entitlements to supply teachers who work through an employment agency to the same ‘basic employment and working conditions’ as if they have been recruited directly by the hirer (e.g. school), if and when they complete a qualifying period of 12 weeks or more in the same job.

The Regulations make it clear that this entitlement extends to pay and other basic working conditions, including annual leave and rest breaks.

As such, after the qualifying period, a supply teacher working through an employment agency is entitled to be paid the same as a comparable employee at the school and would be entitled to the same working time and annual leave as other teachers who are equivalent workers under the AWR.

If you are employed through an employment agency and deployed in a maintained or local authority school, you should receive a daily rate of pay calculated by dividing the relevant annual salary by 195 (number of days to be worked in a normal academic year in England and Wales).

This would ensure that you would be in receipt of an element of rolled-up holiday pay for each day worked.

In this case, the rolled-up holiday pay would be in respect of annual leave and not just statutory leave.

As the rolled-up holiday pay would effectively be for 65 days’ paid leave (260 working days per year – i.e. 52 weeks in the year x 5 working days per week – minus 195 days), it would fully offset the value of any claim for 28 days’ statutory holiday pay.

Therefore, in such circumstances, you would not be entitled to an additional 5.6 weeks’ paid annual leave in circumstances where you are paid as an equivalent worker.

Supply teachers working through local authority pooled supply

For supply teachers working through local authority pooled supply, you should be employed and paid according to the School Teachers’ Pay and Conditions Document (STPCD) in England or the School Teachers’ Pay and Conditions (Wales) Document (STPC(W)D) in Wales, which defines the pay, conditions of service (including working time) and professional duties of teachers.

The STPCD/STPC(W)D defines the pay, conditions of service (including working time) and professional duties of teachers. They are national frameworks and are both statutory and contractual.

Both the STPCD and the STPC(W)D describe supply teachers as ‘short notice’ teachers and stipulate that they must be paid as follows:

‘Teachers employed on a day-to-day or other short notice basis must be paid in accordance with the provisions of this Document on a daily basis calculated on the assumption that a full working year consists of 195 days (193 days for the school year beginning in 2022), [2] periods of employment for less than a day being calculated pro rata.’

This requires that supply teachers employed under the provisions of the STPCD/STPC(W)D must be paid in accordance with the pay ranges and pay scales that apply to other teachers. In determining your daily rate, the local authority must calculate this on a pro rata basis on the assumption that your working year consists of 195 working days (193 working days for the academic year 2022/23 only).

Daily rate = X (annual salary) ÷ 193 days (for 2022/23 only).

In addition, both the STPCD and STPC(W)D provisions relating to supply teachers state that:

‘A teacher to whom paragraph 42.1 [3] applies /41.2 [4] applies and who is employed by the same authority throughout a period of 12 months beginning in August or September must not be paid more by way of remuneration in respect of that period than would have been paid had the teacher been in regular employment throughout the period.’

This would mean that a supply teacher receives a daily rate of pay calculated by dividing the relevant annual salary by 193 (number of days to be worked in the 2022/23 academic year only). Given this, any supply teacher working through local authority pooled supply would be in receipt of an element of rolled-up holiday pay for each day worked.

Supply teachers working directly for a school – England

For supply teachers working directly for a school in England, it will very much depend on how you are employed as to the way in which any annual leave and holiday pay is calculated.

The overwhelming majority of teachers employed in publicly funded schools in England (including academies) are likely to be employed according to the STPCD and, as such, the relevant provisions outlined above should apply to you if you are directly employed by a school.

However, some academies and free schools may operate terms and conditions which do not adhere to the STPCD. They are therefore able to set different pay and conditions which may not adhere to the provisions set out in the STPCD.

Irrespective, the pay you receive is likely to include an element of rolled-up holiday pay.

As such, you should carefully check your contract of employment, including any references to annual leave and holiday pay.

Supply teachers working directly for a school – Wales

As all schools in Wales are covered by the STPC(W)D, supply teachers working directly for a school in Wales should be employed in accordance with the relevant provisions as outlined above for a supply teacher working through local authority pooled supply.

Supply teachers working in Wales through the National Procurement Service (NPS)

For supply teachers employed through an agency on the National Framework developed by the NPS, you should expect to be paid on a minimum rate of pay equivalent to M1.

It is important to note that, following the publication of the STPC(W)D for the academic year 2022/23, the minimum rate of pay that all supply teachers working for an agency on the NPS can expect to receive is equivalent to M2.

As this is based on the established pay scales in the SPTC(W)D and the calculations referenced above, any payment at M2 already includes an element of rolled-up holiday pay for each day worked.

The Union has produced a template letter to assist you when looking to establish your holiday pay entitlement. This should be amended to suit your specific circumstances.

If you have concerns around the response from your recruitment agency and/or umbrella company, these should be raised with your local NASUWT Representative, or, alternatively, you can contact the NASUWT for further advice.

Footnote

[1] https://www.supremecourt.uk/cases/docs/uksc-2019-0209-judgment.pdf

[2] This is taken from the 2022 STPCD/STPC(W)D and reflects the additional Bank Holidays to mark the State Funeral of Queen Elizabeth II and the Coronation of King Charles III in the academic year 2022/23 in schools in England and Wales.

[3] STPCD 2022 and guidance on school teachers’ pay and conditions.

[4] STPC(W)D 2022 and guidance on school teachers’ pay and conditions.

Your feedback

If you require a response from us, please DO NOT use this form. Please use our Contact Us page instead.

In our continued efforts to improve the website, we evaluate all the feedback you leave here because your insight is invaluable to us, but all your comments are processed anonymously and we are unable to respond to them directly.